Now that the crypto market is once again bullish and some of the top cryptocurrencies are once again breaking all-time-highs, a common question I’ve been getting is: as a Canadian, what would I do if I wanted to invest $1K in crypto today in 2021. Many of my friends got in back in the 2017 bull market, but things have changed since then. Often, the question is something along the lines of “what’s the best way to enter the market these days with CAD?”. Another is whether I think it’s too late to invest in crypto. I’m certainly not qualified to give financial advice, but I can explain my own approach as a reference for those looking to get started.

Is It Too Late To Enter the Crypto Market?

First of all, be ready to lose anything you invest in when buying crypto assets. Many of the coins and tokens I have purchased went to zero and it’s not uncommon and should be anticipated. You should only be investing what you are prepared to lose.

I often feel like I’ve missed the bus for certain coins as I watch them go up and up and up. The problem is, I often find myself checking in on these coins each month and wishing I got in the month before. Once you’ve identified the crypto assets you’d like to buy, the commonly shared wisdom is to dollar-cost-average (DCA) your way in. This means that you buy it in chunks over time. This approach spreads out your risk of buying at the peak at any time and allows you to take advantage of any dips in price along the way.

How Would I Invest $1,000 Today?

This is only an example of what you could do and is in no way a recommendation. You’ll have to do your own research to figure out what coins you personally want to buy, if any. Full disclosure: I own these assets myself.

I’m a fan of having at least a small amount of as many crypto assets as I can. Some coins will die and some go to the moon. Generally, I’m a fan of buying a bunch and holding them long-term with the thinking many will be worth much more down the road. If you read my post about it already, I suggest you start building your collection for free by getting free coins in exchange for watching videos on Coinbase Earn.

Generally, if I was just getting into the market today, I would probably start with the following allocation:

- 25% BTC (Bitcoin)

- 25% ETH (Ethereum)

- 25% XLM (Stellar Lumens)

- 25% WAXP (Wax tokens used on the WAX blockchain)

Rationale for this Asset Allocation

Why 25% WAXP Token?

WAXP is an easy one to explain the rationale for buying from my perspective. The reason is that both bull markets and bear markets, I’ve continued using this token and interacting with the WAX ecosystem. Similarly, there’s an entire community surrounding WAX with spokespeople active on Twitter, Twitch, and Discord. Some of these streamers often share updates about the latest news within the WAX ecosystem and often offer giveaways during their streams as well. This is a great way to start getting your feet wet in the space before you are ready to throw some skin in the game. Two streamers you can start checking out for free that do giveaways are Burst of Energy (a fellow Canadian that cares deeply about the space) and NeonSpaceNFT (team of US-based roommates that make NFTs on WAX and hold frequent and consistent streams). Set yourself a WAX wallet today and go check them out!

WAX tokens are predominantly used for NFT-related activities, but not exclusively. There’s so much to explore, but you can start by checking out it’s primary NFT-trading platform: AtomicHub. If you’re familiar with OpenSea, this is the equivalent on WAX. You’ll find the assets to be far cheaper than their ETH-equivalents and gas fees on WAX are negligible. Making transactions on WAX is super fast which also makes it a popular ecosystem for blockchain games.

An example of a popular game integrated with WAX is Alien Worlds. Most of the games are of a P2E (play-2-earn) nature, but tread cautiously, few come out ahead. In fact, if you look at the list of the most popular games all-time on the platform, many are effectively dead today, unfortunately. A quick example is Farmers World. Overall, the amount of transactions made in the game amounted to 9 figures measured in USD! Today, it’s common to see a total daily volume under $10. You’ve been warned.

Why 25% Bitcoin?

Bitcoin is the one you and your dentist most likely already know about. It’s the OG of crypto that performs phenomenally well and while its death is often proclaimed, it always seems to pull through and grow. It is often referred to as digital gold and a safe haven from traditional markets. Some believe this may replace the U.S. dollar as the reserve currency of the world. I feel sorry for anyone that has zero Bitcoin.

Why 25% ETH?

Ether (ETH) is the token used on the Ethereum blockchain and is the 2nd largest crypto by market cap and many tokens are built on top of it. UNI token and USDT Tether are just two popualr examples of these. While Bitcoin is viewed as a store of value and occasionally as a currency, ETH is used to execute smart contracts that allow you to do all kinds of amazing things like insure your investments, invest in DEFI, swap tokens without a centralized intermediary, trade NFTs, and even raise your own digital cat! ETH transactions require gas fees which are also paid in ETH, so you’ll always want to keep some ETH handy.

Why 25% XLM?

Why Stellar Lumens (XLM)? I’ll admit, I don’t use this as much I do the others. This one has a special place in my heart because when I first entered the market, this was one of the lower-cost tokens with a large market cap which is always fun to buy for new investors because instead of buying a fraction of a coin/token as you would have with BTC, $250 CAD can buy you well over a thousand of these bad boys. Alt coins like this one can swing strongly either way when the market moves, so it’s fun to have some to expose yourself to further upside when things are green, but be ready to lose a lot at the same time since they tend to be far from stable.

I’ll admit that I’m not as familiar with Stellar as I am BTC, ETH, and WAX, but I can say that it’s held its place in the top 100 crypto assets by market cap for as long as I remember whereas many others have been introduced and died alongside it over the year. I think that speaks volume about it. Moreover, when I do hear about Stellar, it’s often about it’s actual utility, developer ecosystem, and progress. I get the impression there’s an active community there that keeps developing while there seem to be many other teams that seemed more intent on centering discussions around marketing and tokenomics. I really don’t know what to expect long-term with this one, which frankly, is partially why I find it interesting to hold longer-term.

What We’ll Need to Get Started

At the time of writing, not all crypto assets can be purchased in one place. For this reason, when you are first getting started, you’ll find that there are a bunch of services to sign up for as not all exchanges offer all assets. I’d start by getting these set up first since there are often lengthy identity verification processes that can take a while, so the sooner you kick them off, the sooner you’ll be able to start building your portfolio. Note that many of the links below are referral links. Don’t feel obligated to use them. You can also paste the links in your browser and strip the query string if you’d rather not use my referral code. I included them because often this allows both anyone that uses them and I to benefit from referral bonuses.

[Update 2013-07] Crypto.com actually sells all the coins listed here now. Newton sells all but WAXP. Feel free to look up who offers lower fees/exchange rates between crypto.com and Newton.

Step 1: Sign Up for the Required Tools

Here’s a list of the apps I’d need to sign up for to execute my plan:

- Newton (Website. They have an app available that I haven’t tried yet)

- Crypto.com (Mobile app. Referral code: gnnfvkxfmn)

Step 2: Buy the Tokens

A Newton account can be used to buy everything except for WAXP, which I’d use crypto.com for. To start, I’d fund my Newton account using an e-transfer from my bank. In this example, I’ll assume we want to invest $1,000. We can transfer the full amount we want to invest, e.g. $1,000 CAD, to Newton. If any of these steps aren’t straight-forward and you can use a more detailed explanation, let me know in the comments below and I can make more detailed follow-up posts.

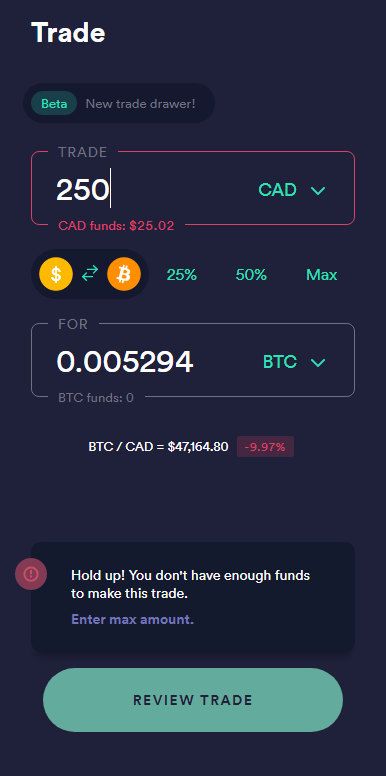

Step 2a: Buy Bitcoin

This part should be pretty straight-forward. Now that we should have a Canadian dollar balance at Newton, we can click on “Trade” in the menu on the right and then enter the amount of Bitcoin we want to buy in Canadian dollars. If we want to buy $250 CAD worth of BTC, we’ll put 250 in the first box. Never touch the 2nd input box as that one tells you how much BTC (Bitcoin) you’ll get for your money. This number will be different from what’s shown in the screenshot before it depends on the price of Bitcoin, which fluctuates wildly. Then, click “Review Trade”.

After clicking “REVIEW TRADE”, it’ll ask you to confirm the amount you entered, then click “Buy BTC” and the process will begin. It can take a while for the transaction to complete, but Newton will show the BTC balance in your account when it is done.

If anyone gets this far, congrats! You’re no longer a no-coiner 🙂

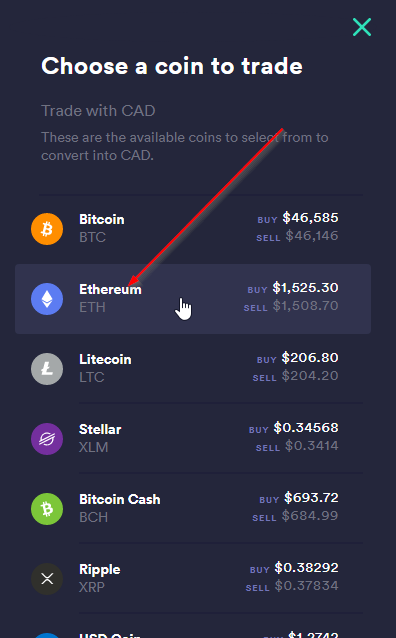

Step 2b: Buy ETH and XLM

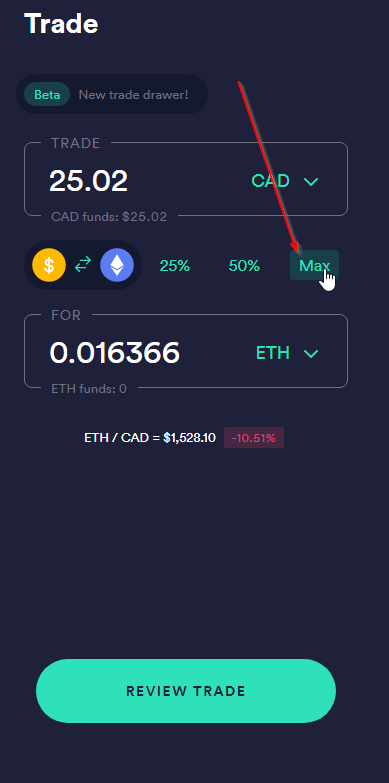

Now that we have BTC, what’s left to buy is ETH, XLM, and WAXP, however, because Newton doesn’t sell WAXP, after buying ETH we’ll use the remainder of our account balance to buy XLM. We’ll keep half of that XLM for ourselves, as planned, then use the other half to buy WAXP. We can buy ETH and XLM the same way we bought BTC, except after clicking “Trade”, we’ll need to click on BTC in the second box. A menu will appear and we’ll have to select ETH or XLM.

After buying ETH, because we’re going to use the remainder balance of our CAD balance now that we bought the rest, in the first box, we can simply click “Max” and Newton will enter our remaining CAD balance (I only had $25.02 in my account when I wrote this. This number will be different). Make sure the first box shows “CAD” and the second box shows “XLM” where it says ETH below. We can then proceed with the transaction as before. Again, it will take some time for the transaction to complete.

Step 2c: Buy WAXP

- Open the Crypto.com app

- Click the logo in the bottom-center of the screen to pop the menu

- Select “Crypto Wallet”

- Select “Transfer”

- Select “Deposit”

- Select “XLM”

- Copy the XLM wallet address or keep it open if you want to use the QR code

- Go to Newton

- Proceed with the XLM withdrawal but we can specify 50% as the amount to withdraw instead of calculating it ourselves, and for the withdrawal address, we can paste the one we copied from the app in step 7 above, or you can scan the QR code on your phone

- Wait for the transaction to process. When it’s done, if we go back to the “Crypto Wallet” section of the Crypto.com app, we’ll see a non-zero value for XLM

- On the Crypto Wallet page, click the Buy button

- Select WAX (WAXP)

- Tap “Crypto”

- Select XLM

- Select “Max (<amount here> XLM)” and hit the big blue button to buy, following any prompts

- Once the transfer is done (it will take time), we should see a positive value for XLM in the Crypto Wallet section

Step 3: Move Your Crypto to Its Proper Home

Disclaimer

Now that we have purchased our crypto assets, we could in theory just leave them where they are, come back a few years from now and – if everything goes well – we’ll hopefully find ourselves wealthier than when we started. However, this is a bad practice.

Why? As the saying goes in crypto: “Not Your Keys, Not Your Coins”. What does this mean? Usually, in crypto, you have a public/private key pair for your wallet where your coins are stored. An oversimplification to help you understand it would be that your public key is like your username and your private key is like your password for the wallet. Your private key is what gives you full control over your crypto and by leaving them on the exchanges only they have the keys. If the exchanges were to disappear tomorrow – which absolutely happens, unfortunately – you risk losing everything!

There are many options ranging from cold storage to mobile wallets and a whole lot more, but that’s a massive tangent outside the scope of this list. There is plenty of literature should you want to learn more about it. Andreas Antonopoulos’ videos would be a great reference if you want to learn more.

If you want to follow the best practice, it would be to get your crypto off the exchanges and into a non-custodial wallet, which means you own the keys. The steps to do this vary for most coins as there are different wallets for different blockchains. In this example, it just so happens that BTC, ETH, WAX, and XLM are all on separate chains, so you’ll probably find yourself having to make 4 different wallets.

Keeping It In a Custodial Wallet

If you are looking to keep your assets in custodial wallets, that is, in the custody of a third-party, one option could be crypto.com since as of 2023 they now support all the coins listed and you’ll have the benefit of having them all in one place. Additionally, crypto.com is one of a number of platforms that allow you to lend your assets out to earn interest in crypto. This is a very risky practice and similar platforms like Celsius and Voyager have gone belly up. Richard Heart, founder of Hex has often discouraged this practice and has compared it to picking up pennies in front of freight trains. All this said, if you move your crypto to crypto.com, they offer (as per the time of writing) 1% on BTC and 1.5% on ETH.

Moving Our Assets to Non-Custodial Wallets

Earlier in this write-up we already went over how to move crypto out of Newton. The process for moving crypto out of crypto.com to another wallet is pretty intuitive. You essentially go to your in-app wallet, select the crypto you want to withdraw, select the amount to withdraw, and provide the new address you want to send your wallet to. The address you send you wallet to can be found within the wallet you decide to use.

Different Wallets for Different Chains

Storing Bitcoin

As Bitcoin is most popular crypto coin in the world today and has been around since 2009, there are many wallet options. Options range for more secure ones like Hardware and multisig wallets, to less secure options like web wallets and lightweight mobile wallets. Instead of trying to list the available options here, I will link to this wiki page on bitcoin.it which lists them in detail.

Storing Ether

Similar to Bitcoin, Ethereum has been around since 2015 and there are many options for storing Ether as well as the token built on the Ethereum blockchain. For small amounts, Metamask is a popular option for users. It can be installed as a Chrome browser extension and supports other chains as well. Metamask can also be used with a hardware wallet for extra security.

Storing XLM

As I mentioned earlier, I haven’t interacted quite as much with Stellar as I have other chains. My personal experience in storing Lumens (XLM) are on a Ledger device (highly regarded hardware wallet) and using StellarTerm, which is a convenient hot wallet, but less secure than using a hardware wallet. While there are other options available, I can personally speak of any of them, so I would encourage you to research the options available at the time if you choose to buy Lumens and see what sounds right for you. One place to start might be by perusing the list of wallets mentioned directly on Stellar’s web site.

Storing WAXP

WAX is pretty straight-forward as far as options go. The main options are the Cloud Wallet which is a popular web wallet and Anchor which is a more secure option that you can install locally. Anchor wallet is also compatible with the Ledger hardware wallet. I think Wombat may have a wallet, but I haven’t used it. Scatter is another option, but I don’t even know of anyone that uses it.

Step 4: Keep Track of Our Portfolio

While we can often watch the value of our assets fluctuate over time in their respective wallets, it can help to use a tool that will help us keep track of our entire portfolio over time. I personally experiment with a bunch of tools. So far, I’d say my best experience has been with CoinTracking because they support a lot of coins and tokens, can produce tax reports based on ACB to meet the standards of the Canadian tax authorities, and can import transactions using many methods ranging from manual input, to CSV imports and even automatic API imports. Other than CoinTracking, CoinTracker is another popular one and Blockfolio is quite popular as well.

Conclusion

And there you have it! I know it looks like a lot of steps, but I was careful to go into great detail so that even total newbies could hopefully follow to gain a better understanding of what I would do. I hope you found it useful.

Disclaimer

I just want to re-emphasize that this is not financial advice! This is meant to serve as a guide for my friends that asked how I would go about investing $1,000 CAD today myself. If someone chooses to follow these steps they risk losing everything. There are lots of risks associated with cryptocurrencies including, but not limited to: exchange hacks, fraud, phishing attempts, human error in entering addresses, theft, new regulation and lawsuits. Proceed at your own risk. You are responsible for doing your own research and due diligence and as always you should consult with a professional financial advisor before making investment decisions of any kind. I cannot be sure there are no mistakes in the steps I wrote and I don’t recommend anyone follow them as written without understanding what they are doing as I will not be responsible for any mistakes.